The insurance customer journey starts with the awareness of the need for an insurance product and goes through policy purchase, making claims, and renewing the policy. Each step in this journey is a chance to make the customer happy. Optimizing this journey is very important. Happy customers are more likely to stay with the company and recommend it to others, leading to better business performance. In this article, we discuss how insurance companies can improve key touchpoints of the customer journey. We will share simple strategies that can make a big difference in customer satisfaction.

Understanding the Insurance Customer Journey

In insurance businesses, the customer experience is influenced by various factors, including the increasing expectations of customers and demand for more digital interactions while still being able to get personal advice and recommendations. The insurance customer journey is highly connected to customer life events, such as a car or home purchase, the birth of a child, or a health issue. These events determine the specific needs and interactions customers will have with their insurers, highlighting the importance of both digital and physical touchpoints in creating a comprehensive and satisfying customer experience.

Digital vs. Physical Experiences

In the insurance industry, digital and physical experiences differ significantly. Digital experiences occur online and include activities such as buying a policy on a website or using a mobile app to manage coverage. These interactions are convenient and can be accessed anytime, providing flexibility for customers. Physical experiences, on the other hand, involve face-to-face or telephone interactions. Examples include meeting with an insurance agent in person or calling customer service for assistance. These interactions often provide a personal touch and can help build trust and rapport with customers.

For instance, a customer might buy a policy online, which is a digital touchpoint. Later, they might need to meet an agent in person to discuss coverage options, which is a physical touchpoint. Both types of interactions are crucial and serve different purposes in the customer journey.

Types of Insurance Customer Journeys

The customer journey varies depending on the type of insurance: auto, health, life, or home insurance, for example. Each type has its own set of steps and touchpoints.

In auto insurance, purchasing a new car is the life event that usually triggers the journey. After initial research, customers typically request quotes from a few insurers, which can be done online or in person. After purchasing the policy, a significant touchpoint occurs when the customer files a claim following an accident or issue with the car. The ease and speed of this process can greatly affect customer satisfaction.

For health insurance, selecting the right plan is often time-consuming and can involve online research, using comparison tools, or consulting with an agent. Once the plan is in place, using the benefits for medical care is a key touchpoint. Customers interact with healthcare providers and may need to navigate claims and reimbursements, which can be done through digital platforms or by contacting customer service.

Life insurance involves a different journey. The initial setup of the policy is a crucial step where customers may need detailed explanations and advice, often provided in person. Later, the policyholder’s beneficiaries will interact with the insurance company to file a claim after the policyholder’s death. This touchpoint is highly sensitive and requires compassionate and efficient service.

Home insurance starts with an inspection of the property, which is typically a physical touchpoint. The policyholder needs to understand what is covered and how to protect their home. If damage or loss occurs, filing a claim becomes a critical touchpoint. This can involve both digital submissions and physical inspections to assess the damage.

Each type of insurance journey includes unique customer interactions that are essential for a positive overall experience. By understanding these specific journeys, insurance companies can tailor their strategies to meet their customers’ distinct needs, ensuring a smoother and more satisfying experience.

Key Touchpoints in the Insurance Journey

Every insurance journey starts with awareness of the need, usually triggered by a life event, such purchase of a new home or car. After that, customers start the research process which may be more or less digital depending on customers’ preferences.

Initial Contact and Information Gathering

This touchpoint involves gathering information from one or several insurance companies and their product portfolio and services. This can happen through a website, a mobile app, a phone call, or an in-person visit. A common pain point at this stage is the difficulty in finding clear and concise information about policies. Customers might feel overwhelmed by the complexity of insurance terms and conditions.

Strategies for Increasing Customer Satisfaction:

- Provide clear, easy-to-understand information on your website and other communication channels.

- Offer interactive tools and resources, such as FAQs, chatbots, and comparison charts, to help customers make informed decisions.

- Ensure that customer service representatives are well-trained to provide concise and helpful information.

Quote and Policy Purchase

After gathering information, the customer requests quotes and purchases the selected policy. This stage can be both digital and physical. In this stage, customers may experience frustration due to lengthy forms, unclear pricing, or slow response times.

Strategies for Increasing Customer Satisfaction:

- Simplify the quoting process with user-friendly online forms and instant quotes.

- Provide transparent pricing and clear explanations of what is included in each policy.

- Offer multiple channels for purchasing a policy, including online, over the phone, and in person, to cater to different customer preferences.

Onboarding and Welcome Process

Once the policy is purchased, the onboarding process begins. This stage includes setting up the policy, receiving welcome materials, and understanding the policy details. A common pain point is the lack of personalized attention and support during this process.

Strategies for Increasing Customer Satisfaction:

- Send a personalized welcome package with easy-to-read materials explaining the policy.

- Provide a dedicated customer service contact for new policyholders to address any questions or concerns.

- Use automated systems to send reminders and updates during the onboarding period.

Claims Process

Filing a claim is one of the most critical touchpoints in the insurance journey. Customers often find this process stressful and frustrating, especially if it involves long wait times, poor communication, or denied claims.

Strategies for Increasing Customer Satisfaction:

- Streamline the claims process with online claim submissions and status tracking.

- Ensure clear and frequent communication throughout the claims process, providing updates on the status and expected timelines.

- Train claims representatives to handle claims efficiently and empathetically, addressing customer concerns promptly.

Customer Support and Service

Throughout the customer journey, access to reliable customer support is essential. Customers might face challenges such as long wait times, unhelpful representatives, or difficulty reaching the right department.

Strategies for Increasing Customer Satisfaction:

- Implement a multi-channel customer support system, including phone, email, live chat, and social media.

- Reduce wait times by using AI-driven chatbots and automated responses for common inquiries.

- Regularly train customer service staff to ensure they provide accurate, helpful, and friendly support.

Renewals and Policy Changes

As the policy term comes to an end, customers will need to renew or make changes to their policies. Common pain points include complicated renewal processes, unexpected premium increases, and lack of communication.

Strategies for Increasing Customer Satisfaction:

- Simplify the renewal process with online renewal options and automatic reminders.

- Provide clear explanations for any changes in premiums and offer loyalty discounts where applicable.

- Ensure that customers can easily update their policies online or through a quick call to customer service.

Each insurance type and touchpoints have their own set of customer challenges and pain points. Insurance providers should proactively address these areas of friction to increase customer satisfaction in every touchpoint resulting in a better overall customer experience.

Measuring Customer Satisfaction Across Touchpoints

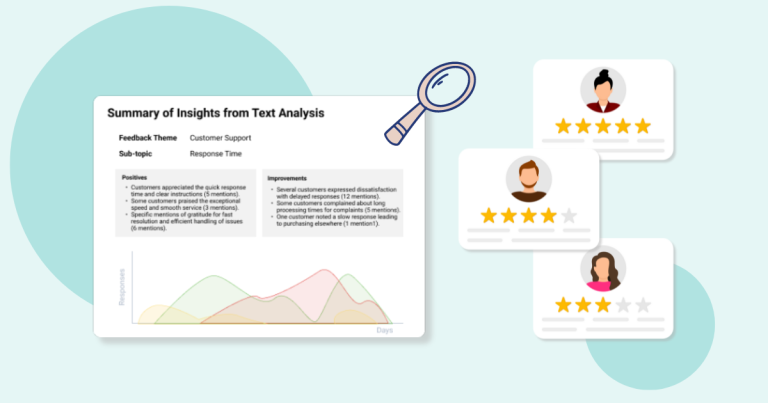

To effectively measure customer satisfaction across different touchpoints, insurance companies can use a variety of tools and techniques. Surveys and feedback forms are a primary method for gathering direct customer input. These can be distributed through email, mobile apps, or on the company’s website after key interactions.

Another valuable metric is the Net Promoter Score (NPS), which measures how likely customers are to recommend the company to others. Customer Satisfaction (CSAT) scores, which gauge overall satisfaction with specific services or interactions, are also crucial. Together, these metrics provide a comprehensive view of customer satisfaction.

Analyzing Feedback and Identifying Pain Points

Once feedback is collected, it’s essential to analyze the data to understand customer experiences. Data analytics tools can help identify trends and patterns in the feedback, highlighting common pain points and areas where the company can improve.

For example, if multiple customers report delays in the claims process, this indicates a need for streamlining and improving that touchpoint. By pinpointing these issues, insurance companies can focus their efforts on the most critical areas affecting customer satisfaction.

Implementing Changes Based on Feedback

Acting on customer feedback is crucial for improving the insurance customer journey. Strategies for implementing changes include updating processes, training staff, and leveraging technology to enhance customer interactions.

For instance, if feedback indicates that customers find the policy renewal process confusing, the company can simplify the process by offering clear online renewal options and automated reminders. Real-world examples show that feedback-driven changes can lead to significant improvements in customer satisfaction. Companies that actively listen to and act on customer feedback often see increased loyalty and positive reviews.

By continuously measuring and analyzing customer satisfaction across touchpoints, insurance companies can create a more responsive and customer-centric experience. This ongoing commitment to improvement helps build trust and fosters long-term relationships with customers.

Wrapping up

Optimizing the insurance customer journey is crucial for achieving high customer satisfaction and business success. By understanding the differences between digital and physical experiences, addressing specific challenges in various types of insurance, and focusing on key touchpoints, insurance companies can create a more seamless and positive experience for their customers. Measuring customer satisfaction through tools like surveys, NPS, and CSAT scores, analyzing feedback to identify pain points, and implementing changes based on this feedback are essential strategies for continuous improvement. By committing to these practices, insurance providers can build stronger relationships with their customers, foster loyalty, and stand out in a competitive market. Through a customer-centric approach, insurers can ensure that their customers feel valued and supported at every stage of their journey.

Did you like the post?

You might also like:

Surveypal

Everything you need to lead and improve your customer experience. Learn more at surveypal.com, or